DMCA

MENU

- الفئات

- مقال عن الكتابة

- مقالات باللغة الانجليزية

- سيره ذاتيه بالانجليزي

- كتابة ايميل بالانجليزي

- طلب وظيفة بالانجليزي

- كتابة ايميل بالانجليزي قصير

- كتابة بالانجليزي

- تصحيح لغوي انجليزي

- تصحيح لغوي انجليزي اون لاين

- مصحح لغوي انجليزي

- مصحح لغوي انجليزي اون لاين

- طريقة كتابة cv باللغة الانجليزية

- مدقق املائي انجليزي

- مواضيع باللغة الانجليزية

- كتابة مقال بالانجليزي

- كتابة مقال باللغة الانجليزية

- كتابة موضوع باللغة الانجليزية

- مقال بالانجليزي

- Cv انجليزي

- اعداد السيرة الذاتية

- السيرة الذاتية باللغة الانجليزية

- مقال انجليزي

- مقال باللغة الانجليزية

- كتابة السيرة الذاتية بالانجليزي

- وصف شخص بالانجليزي

- كتابة مقال

- اكتب مقدمة قصيرة للنص التالي

- مقال علمي قصير جدا

- كتابة سيرة ذاتية بالانجليزي

- روتين يومي بالانجليزي

- مقال انجليزي قصير

- وصف صديق بالانجليزي

- وصف المنزل بالانجليزي

- حوار بين شخصين بالانجليزي عن الدراسه

- كتابة ايميل بالانجليزي عن رحلة

- كيف تكتب سيرة ذاتية بالانجليزي

- سيرة الذاتية بالانجليزي

- مقال عن التدخين بالانجليزي

- خطاب بالانجليزي

- تعبير عن نفسك بالانجليزي طويل

- مقال قصير بالانجليزي

- كتابة مقال قصير

- مقال بالانجليزي عن التدخين

- كيفية كتابة مقال باللغة الانجليزية

جني المال

- طريقة لجلب المال

- مشاريع من المنزل

- أريد مال باي طريقة

- جني المال من المنزل

- طرق للحصول على المال

- صناعة المال عبر الإنترنت

- كيف احصل على المال مجانا

- مشروع يدخل ذهب بدون رأس مال

- كيف تحصل على المال وأنت صغير

- كيفية الاشتراك في جوجل ادسنس

- كيف احصل على المال من الانترنت

- كيف احصل على المال وانا في المنزل

- كيف احصل على المال وانا طالب

- كيفية الربح من اليوتيوب

- مشاريع براس مال صغير في مصر

- كيف احصل على المال من الانترنت مجانا

- الربح من المواقع

- كيف تطلع فلوس وأنت صغير

- طريقة جمع المال للاطفال

- مشاريع تجارية كبيرة

- كيف تربح الف دولار يوميا

- مسابقة ربح السيارة

- مسابقة ربح المليون

- ربح دولار يوميا

- ربح المال من الانترنت مجانا

- مشاريع استثمارية

- الربح السريع من الانترنت

- ربح 100 دولار عند التسجيل

- الربح من جوجل بلاي

- الربح من الانترنت مجانا

- مشاريع مربحة

- مشاريع صغيرة مربحة

- الربح من الانترنت

- مواقع الربح من الانترنت

- ربح المال من الانترنت

- مشاريع متوسطة

- ربح المال من الانترنت بسرعة

- افكار مشاريع براس مال صغير

- شركات الربح من الانترنت

- ربح 50 دولار يوميا

- طريقة الربح من التطبيقات المجانية

- ربح ألف دولار يوميا

- افكار مشاريع تجارية

- كيف اجمع المال وانا صغير

- مشاريع لجني المال

- افكار للربح من المنزل

- كيفية الربح من الانترنت للمبتدئين

- اسهل طريقة للربح من النت

- مشاريع غريبة في اليابان

- ربح المال من جوجل بلاي

- أفضل مواقع للربح من الاعلانات

- كيف تربح من جوجل 100 دولار يوميا

- مشاريع ناجحة براس مال صغير

- الربح من الانترنت بدون رأس مال

- كيفية ربح المال من الانترنت للمبتدئين

- أفكار تجيب فلوس

- كيف تربح من الفيس بوك 100 دولار يوميا

- مواقع الربح من الانترنت عن طريق الاعلانات

- مجالات الربح من الانترنت

- مواقع الربح من النت المضمونة

- انشاء حساب جوجل ادسنس

- كم الربح من إعلانات التطبيقات

- مشاريع تصنع الملايين

- الربح من ادسنس عن طريق الفيس بوك

- مشروع يدخل ملايين

- أرباح جوجل بلاي

- كيف تربح مليون دولار في أسبوع

- الربح من جوجل ادسنس للمبتدئين

- تطبيقات الربح من الاعلانات

- كيف تربح من موقع الخرائط

- اربح 100 دولار يوميا من الاعلانات

- فكار صنعت ملايين

- جوجل ادسنس من الالف إلى الياء

- الربح من محرك البحث جوجل

- الربح من خرائط جوجل

- كيف تجني الملايين

- موقع موثوق لربح المال

- الربح من جوجل مابس

- أفكار صنعت ملايين

- مميزات قوقل ماب

- مواقع الربح من الانترنت الصادقة

- اصدق مواقع الربح من الانترنت

- أفضل مواقع الربح من النقر على الاعلانات

- شركات الربح من الانترنت الصادقة

- أفكار تجلب الملايين

- كورس الربح من خرائط جوجل

- جاوب علي الأسئلة واربح

- الربح من جوجل درايف

- الشركات الربحية الصادقة الاكثر في المال

مواقع أخرى الإقليمية

Duration 10:14

Option vega (FRM T4-17)

6 712 watched

0

171

Published 28 Feb 2019

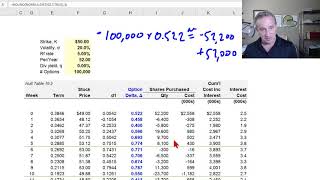

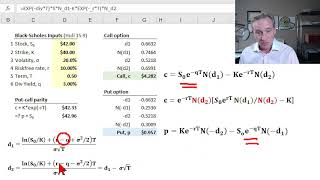

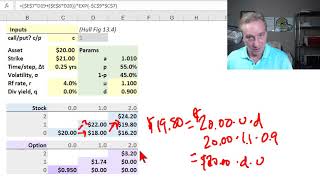

[my xls is here https://trtl.bz/2T7KDtG] Vega is the sensitivity of an option's value to volatility. Vega tends to be highest when the option is at-the-money (ATM). In this example, where S = K = 100, σ = 30%, T = 1.0 year, and Rf = 4.0%, the vega is 38.32. This is the (linearly estimated) change in the option value per one unit (ie, 100%) change in volatility. Therefore, this vega predicts a change of +$0.38 if the volatility increases by +1.0% to 39.0%. In this way, by convention, we could divide the 38.32 by 100 = $0.3832 to express vega as the dollar change per PERCENTAGE POINT change in volatility. Discuss this video here in our FRM forum: https://trtl.bz/30AWCAb

Category

Show more

Comments - 17

Related videos for Option vega (FRM T4-17):